Travel Insurance is so important to protect your travel plans, and most people decline it so quickly and easily without understanding the benefits or what it fully means.

Your travel plans are often expensive, and your hard earned money needs be protected should something prohibit you from being able to travel, or if you have issues after you leave home to start your trip, OR before you're able to get back home.

The BEST time to purchase your travel insurance is within 72 hours of making your deposit. This will ensure you will receive the best policy available, and it will also mean the most coverage. However, if you do miss this window, that's ok! You can still purchase insurance, the coverage will just be slightly different!!

The 72 hour window allows you to make the most of the "cancel for any reason" clause, up to 80% of the value of the policy, compared to only 50% coverage if you purchase it after that time frame.

But, let's break this down a bit more to help you understand things better.

Cancellation insurance will cover you from the time you purchase your policy for your trip up until the minute you leave your home to start your trip. Cancellation insurance is value-based (ie - the cost of your trip) and age based. It covers you for the unforeseen and unexpected, and allows you to be able to submit a claim for the full amount of your non-refundable trip costs for specific reasons (ie - loss of job, death, sickness, etc - there are 27 reasons!!). However, if you needed to cancel for a reason that was not one of these 27 reasons, then you would need to file a claim called "Cancel for ANY Reason". This means that you would have coverage for 80% (or 50%), of the value of your trip that you have insured. This amount is based on the policy that you buy, and when you buy it. As a reminder, those who purchase their insurance plan within 72 hours of making the deposit can cancel their trip for ANY reason for up to 80% of the value of the trip for the amount you have insured. It is also important to know that cancellation insurance, for those unforeseen and unexpected times, only works on UNKNOWN events, you cannot purchase a trip cancellation policy for an event you are aware of that may cause you to want to cancel (unless you are using Cancel for ANY reason). That is why it is important to purchase cancellation insurance from the beginning, when you first book your trip, before an event becomes known and won't be covered.

Now, let's talk about the often overlooked but the very important trip interruption insurance!

This kicks in when cancellation insurance has ended. Trip interruption insurance covers you from the minute you leave your home to start your trip, until the minute you arrive home from your trip.

It will cover you for things like (examples):

- you left the house and there is an accident and can't get to the airport

- your flight has been delayed

- your flight has been canceled

- meals, hotel, and/or transportation needed due to a delay or cancelation

- your airline doesn't have a new flight that works and you need to book a flight on another airline

- loss of part of your land/cruise portion, you have coverage for a prorated amount of your trip for the lost portion

There are limits to each portion that is covered, but they are very generous.

If you don't have trip interruption coverage, then all these expenses are coming out of your own pocket your should experience some type of interruption to your trip.

With trip interruption insurance you simply keep all your receipts, open a claim and submit the receipts for reimbursement! There is so much value is having interruption insurance!

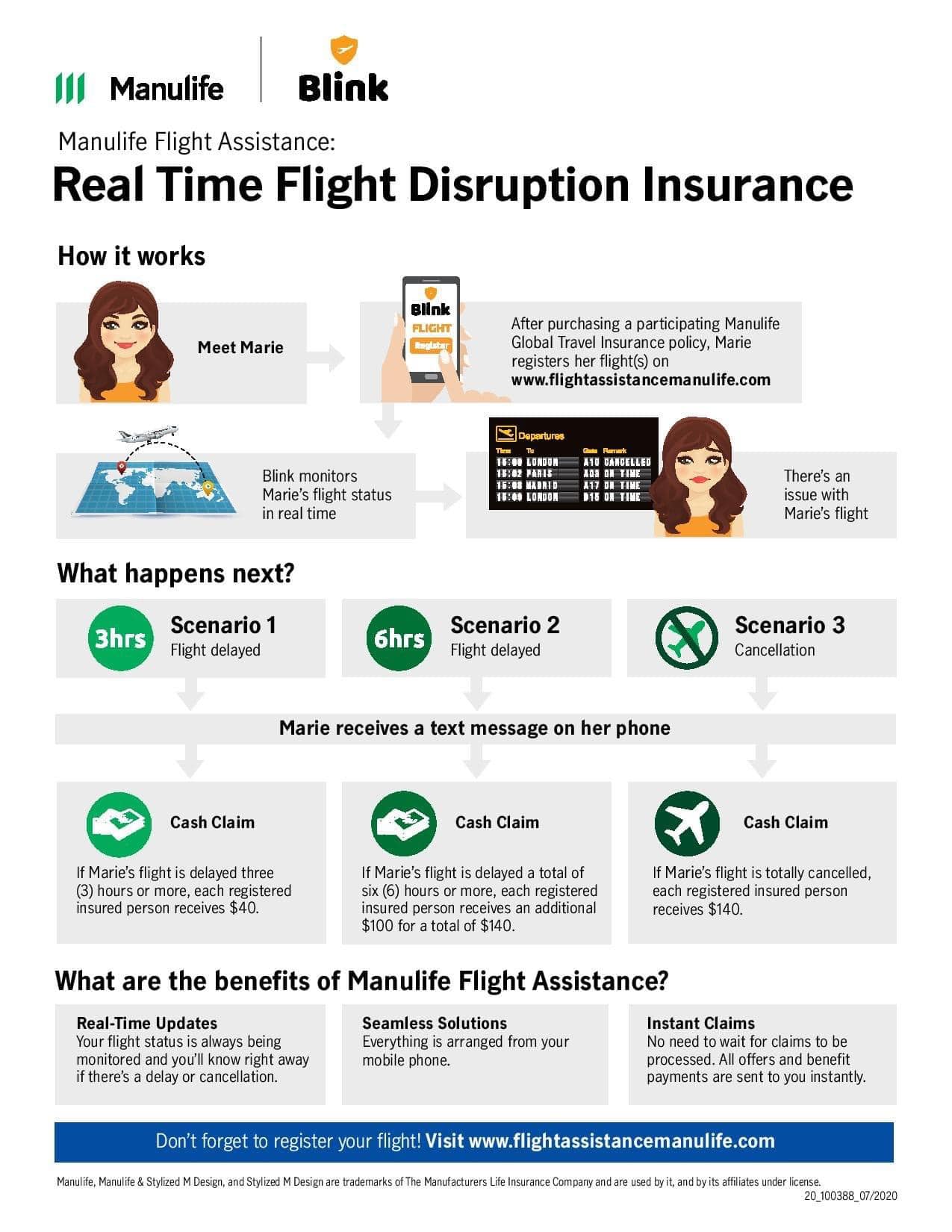

In addition, Manulife offers "Flight Assist" as part of the Trip Interruption benefit, this is a FREE included benefit!!!

Flight Assist will deposit immediate money straight into your account if there are long delays to help with unexpected expenses!

This is in ADDITION to the benefits of your interruption policy.

Cancellation and Trip Interruption Insurance does come bundled as one package, and as mentioned, the price of the policy is based on the value of the trip (and the traveler's age; and when applicable, medical condition of travelers). Having these combined together makes it very easy to protect your trip from start to end. These insurance plans also include funds for lost baggage! And if you need emergency out of country medical coverage, we can make sure you have the right insurance policy that includes this too! Of course, emergency out of country medical insurance can also be purchased separately without cancellation and/or interruption insurance.

It is also very important to make you aware of an additional option! If you don't want trip cancelation coverage, but are interested in the interruption insurance, this is an option! The cancellation portion of your trip would be based on ZERO dollars, but you would still have the benefit of the trip interruption portion of the policy and all those benefits. It is very important to note, if you needed to cancel you would not be eligible to submit a claim for the cost of your trip because the value of your trip was noted as zero.

Whew! That's a lot to understand!!

That is why as your travel consultant we are here to advise you to make sure you have the best option for your travel dollars and to understand how it will benefit you, should you need to utilize it.

"I don't need to buy insurance, I have work coverage."

Often people want to check their work policy for insurance, which is great, although 99% of the time the insurance that is covered through employers is out of country medical insurance, not insurance that covers trip cancellation and interruption. Make sure you understand what is being covered and what is not.

"I don't need to buy insurance, my credit card has coverage."

If you feel your credit card has trip cancelation and interruption protection just make sure to look into detail on what that coverage is.

Please use this handy link to check and be sure what exactly is covered and what the limits are for that each of those options.

Click here to check your credit card insurance

Not all insurance is created equal. Not all coverage is the same.

You've worked hard to earn the money to pay for your travel.

Protecting your trip with insurance should be factored into your budget when planning your travels.

Reach out today to get your quote for the insurance policy that works best for you!